New tax incentive for overseas investors investing in the PRC

March 28, 2018 | BY

Susan MokA new tax deferral policy providing a temporary waiver of EIT to overseas investors investing in encouraged industries is aimed at attracting more foreign capital. If considering expanding further into the PRC, overseas companies should comprehensively review and readjust their current investment strategies to ensure they can benefit from the new tax deferral.

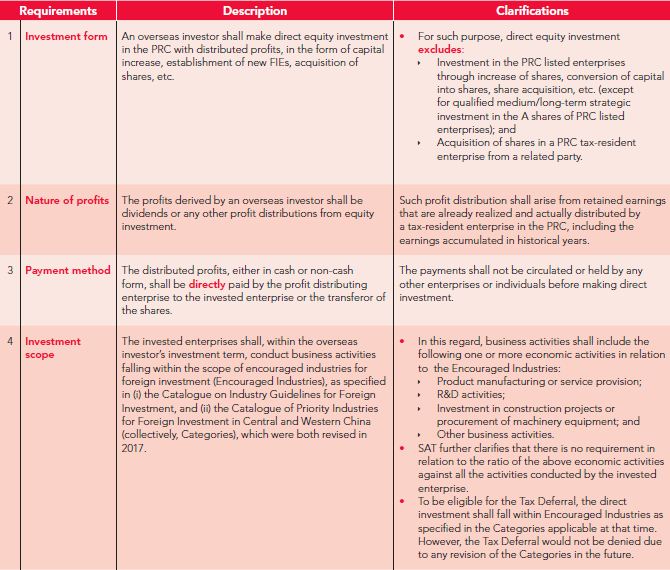

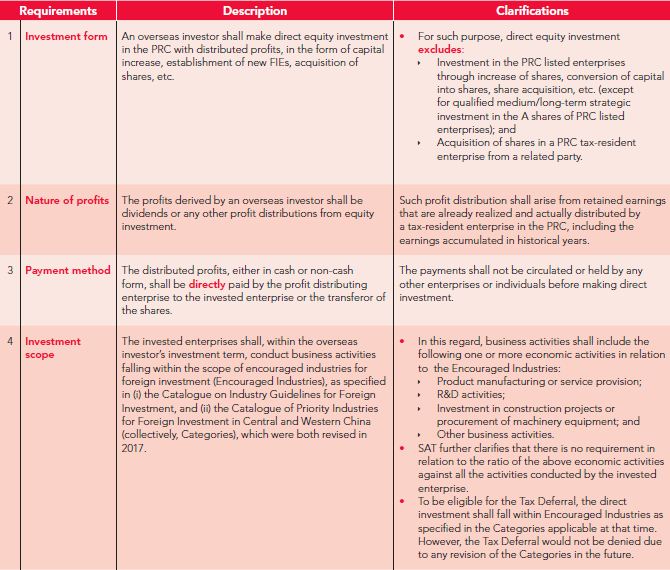

Cai Shui Circular on Issues Concerning the Policy of Provisional Deferral of Withholding Income Tax on Direct Investments Made by Foreign Investors Using Distributed Profits Announcement on Issues Relevant to the Implementation of the Policy of Provisional Deferral of Withholding Income Tax on Direct Investments Made by Foreign Investors Using Distributed Profits WHY DID CHINA RELEASE THIS TAX DEFERRAL POLICY? Circular on Several Measures for the Promotion of the Growth of Foreign Investment IS THIS TAX DEFERRAL SOMETHING NEW? HOW TO QUALIFY FOR THE TAX DEFERRAL?  WHAT STEPS SHALL BE FOLLOWED IN ORDER TO ENJOY THE TAX DEFERRAL?

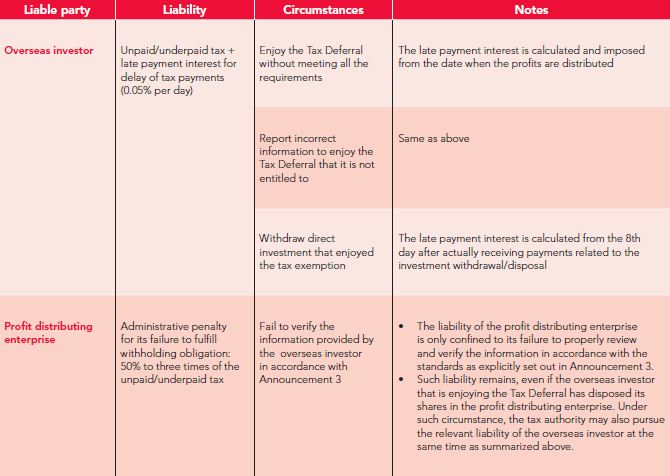

WHAT STEPS SHALL BE FOLLOWED IN ORDER TO ENJOY THE TAX DEFERRAL?  CAN AN OVERSEAS INVESTOR CLAIM THE TAX DEFERRAL TREATMENT AFTER ACTUAL PAYMENT OF TAXES? UNDER WHAT CIRCUMSTANCE S WOULD THE TAX DEFERRAL BE DENIED? AND WHAT IS THE POTENTIAL LIABILITY?

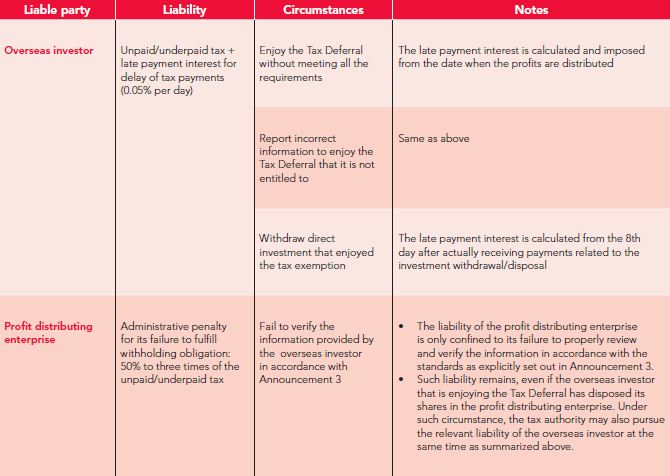

CAN AN OVERSEAS INVESTOR CLAIM THE TAX DEFERRAL TREATMENT AFTER ACTUAL PAYMENT OF TAXES? UNDER WHAT CIRCUMSTANCE S WOULD THE TAX DEFERRAL BE DENIED? AND WHAT IS THE POTENTIAL LIABILITY?  WHEN THE TAX DEFERRAL IS DENIED, IS THE OVERSEAS INVESTOR STILL ENTITLED TO THE BENEFITS OF AN APPLICABLE TA X TREATY OR ARRANGEMENT? Measures for the Administration of the Eligibility of Non-tax-resident Taxpayers for Tax Agreement Benefits OBSERVATION AND RECOMMENDATION Daisy Duan, Partner Linlin Cao, Associate King & Wood Mallesons

WHEN THE TAX DEFERRAL IS DENIED, IS THE OVERSEAS INVESTOR STILL ENTITLED TO THE BENEFITS OF AN APPLICABLE TA X TREATY OR ARRANGEMENT? Measures for the Administration of the Eligibility of Non-tax-resident Taxpayers for Tax Agreement Benefits OBSERVATION AND RECOMMENDATION Daisy Duan, Partner Linlin Cao, Associate King & Wood Mallesons

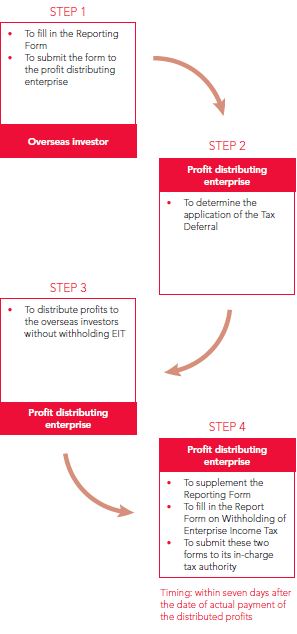

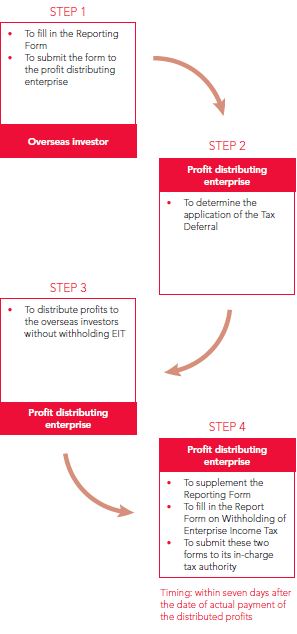

WHAT STEPS SHALL BE FOLLOWED IN ORDER TO ENJOY THE TAX DEFERRAL?

WHAT STEPS SHALL BE FOLLOWED IN ORDER TO ENJOY THE TAX DEFERRAL?  CAN AN OVERSEAS INVESTOR CLAIM THE TAX DEFERRAL TREATMENT AFTER ACTUAL PAYMENT OF TAXES? UNDER WHAT CIRCUMSTANCE S WOULD THE TAX DEFERRAL BE DENIED? AND WHAT IS THE POTENTIAL LIABILITY?

CAN AN OVERSEAS INVESTOR CLAIM THE TAX DEFERRAL TREATMENT AFTER ACTUAL PAYMENT OF TAXES? UNDER WHAT CIRCUMSTANCE S WOULD THE TAX DEFERRAL BE DENIED? AND WHAT IS THE POTENTIAL LIABILITY?  WHEN THE TAX DEFERRAL IS DENIED, IS THE OVERSEAS INVESTOR STILL ENTITLED TO THE BENEFITS OF AN APPLICABLE TA X TREATY OR ARRANGEMENT? Measures for the Administration of the Eligibility of Non-tax-resident Taxpayers for Tax Agreement Benefits OBSERVATION AND RECOMMENDATION Daisy Duan, Partner Linlin Cao, Associate King & Wood Mallesons

WHEN THE TAX DEFERRAL IS DENIED, IS THE OVERSEAS INVESTOR STILL ENTITLED TO THE BENEFITS OF AN APPLICABLE TA X TREATY OR ARRANGEMENT? Measures for the Administration of the Eligibility of Non-tax-resident Taxpayers for Tax Agreement Benefits OBSERVATION AND RECOMMENDATION Daisy Duan, Partner Linlin Cao, Associate King & Wood MallesonsThis premium content is reserved for

China Law & Practice Subscribers.

A Premium Subscription Provides:

- A database of over 3,000 essential documents including key PRC legislation translated into English

- A choice of newsletters to alert you to changes affecting your business including sector specific updates

- Premium access to the mobile optimized site for timely analysis that guides you through China's ever-changing business environment

Already a subscriber? Log In Now

For enterprise-wide or corporate enquiries, please contact our experienced Sales Professionals at +44 (0)203 868 7546 or [email protected]